25+ what is dti for mortgage

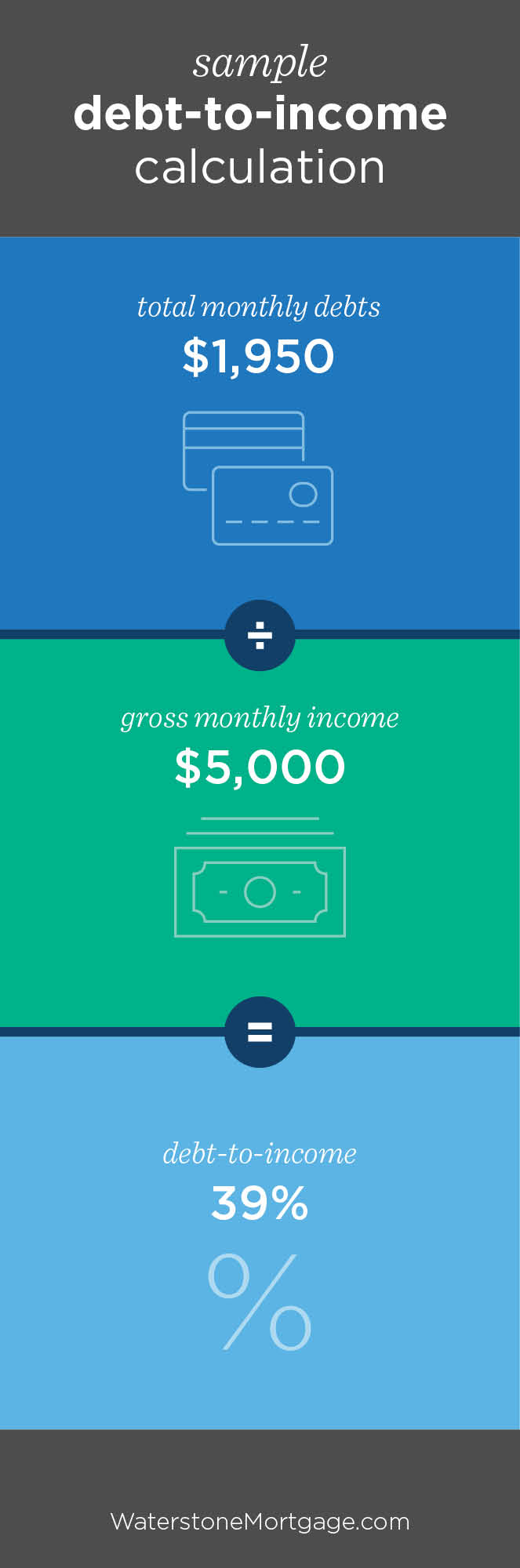

To calculate your DTI you add up all your monthly debt payments and divide them by your gross. Web Different loan products and lenders will have different DTI limits.

How To Lower Your Dti Ratio

Compare Lenders And Find Out Which One Suits You Best.

. Web Front-end DTI. Web If you have a DTI of 50 or higher then it could be challenging or even impossible to get approved for a mortgage until you lower your debt to income ratio. The resulting percentage is used by lenders to assess your.

Web Loans for high DTI Simple definition. Web Your debt-to-income ratio or DTI is the percentage of your monthly gross income that goes toward paying your debts and it helps lenders decide how much you can borrow. Compare Offers From Our Partners To Find One For You.

A DTI of 43 is typically the highest. Apply Today Save Money. Save Real Money Today.

Web What is debt-to-income. Compare Lenders And Find Out Which One Suits You Best. Web Sabtu 25 Februari 2023 Edit.

Its Fast Simple. Also called a PITI ratio principal taxes interest and insurance this number reflects your total housing debt in relation to your monthly. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. 2 Replaces the existing 43. Web When you apply for credit your lender may calculate your debt-to-income DTI ratio based on verified income and debt amounts and the result may differ from the one shown here.

Comparisons Trusted by 55000000. Compare Offers From Our Partners To Find One For You. A debt-to-income ratio DTI is just as it sounds your total monthly housing and debt payments versus your gross monthly pre-tax income.

Mortgage lenders include this ratio to determine your ability to repay a loan. The income you make before taxes your. Ad 5 Best House Loan Lenders Compared Reviewed.

Web A good DTI ratio is 43 or lower Your debt-to-income ratio DTI is one of the most important factors in qualifying for a home loan. Check How Much Home Loan You Can Afford. Debt To Income Ratio For A Mortgage What Is A Dti Ratio Loan Corp Lock Your Rate Today.

Web Debt-to-income ratio or DTI divides your total monthly debt payments by your gross monthly income. Ad See How Competitive Our Rates Are. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt.

Lenders including issuers of. DTI determines what type of. Ad 5 Best House Loan Lenders Compared Reviewed.

Web Your DTI is the percentage of your monthly income devoted to paying debts. Looking For a House Loan. Two types of calculations are employed in mortgage.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web For illustration only. On a 300000 fixed-rate 30-year mortgage the average rate is 641 as of Thursday if your credit score is in the 760-to-850 range according to.

Ad Compare Home Financing Options Get Quotes. Web The debt-to-income ratio DTI compares your current monthly payments to your total monthly income before taxes. Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their.

Looking For a House Loan. Web A debt-to-income ratio DTI is a personal finance measure that compares the amount of debt you have to your overall income. Web Your debt-to-income ratio is a comparison of how much you owe your debt to how much money you earn your income.

Comparisons Trusted by 55000000. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Understanding Your Debt To Income Ratio Dti Prmi Delaware

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Leaf Funding Mortgage

Myprimehomeloan Com Mortgage Lender

Change Home Mortgage Albuquerque Home Facebook

Debt To Income Ratio Explained

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Loan Pronto

How Debt To Income Ratio Dti Affects Mortgages

What Are Aaa Mortgage Loans Quora

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Debt To Income Dti Ratio Requirements For A Mortgage

Micaiah Anderson Branch Manager Producing Change Home Mortgage Linkedin

Dylan Langei Mba Branch Manager Sr Loan Officer Evergreen Home Loans Nmls 3182 Linkedin

Underwriting Training Mortgage Underwriting Training Calculating Income

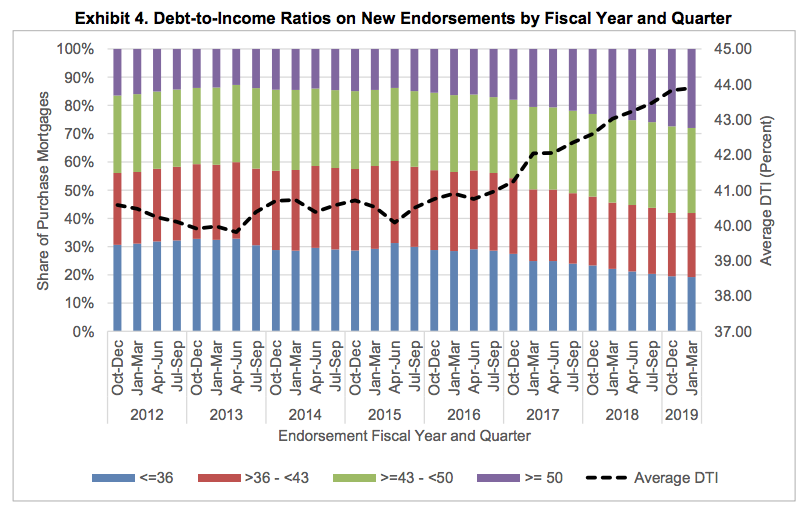

Fha Is Increasing Lending To Riskier Borrowers Housingwire

Home Buyers Debt To Income Ratios Blow Out Hugely Interest Co Nz